Andy_Ross

Penultimate Amazing

- Joined

- Jun 2, 2010

- Messages

- 66,975

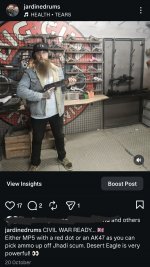

Maybe don't post violent threats, targeted at immigrants, holding a gun.

JARDINE

@oJARDINEo

Just had two Terrorist Prevent officers in my living room advising me that I must stop posting things online.

Three days before Christmas!

This is a deliberate attempt to frighten me. It will not work

His posts

JARDINE

@oJARDINEo

Just had two Terrorist Prevent officers in my living room advising me that I must stop posting things online.

Three days before Christmas!

This is a deliberate attempt to frighten me. It will not work

His posts

Last edited: