dirtywick

Penultimate Amazing

- Joined

- Sep 12, 2006

- Messages

- 10,111

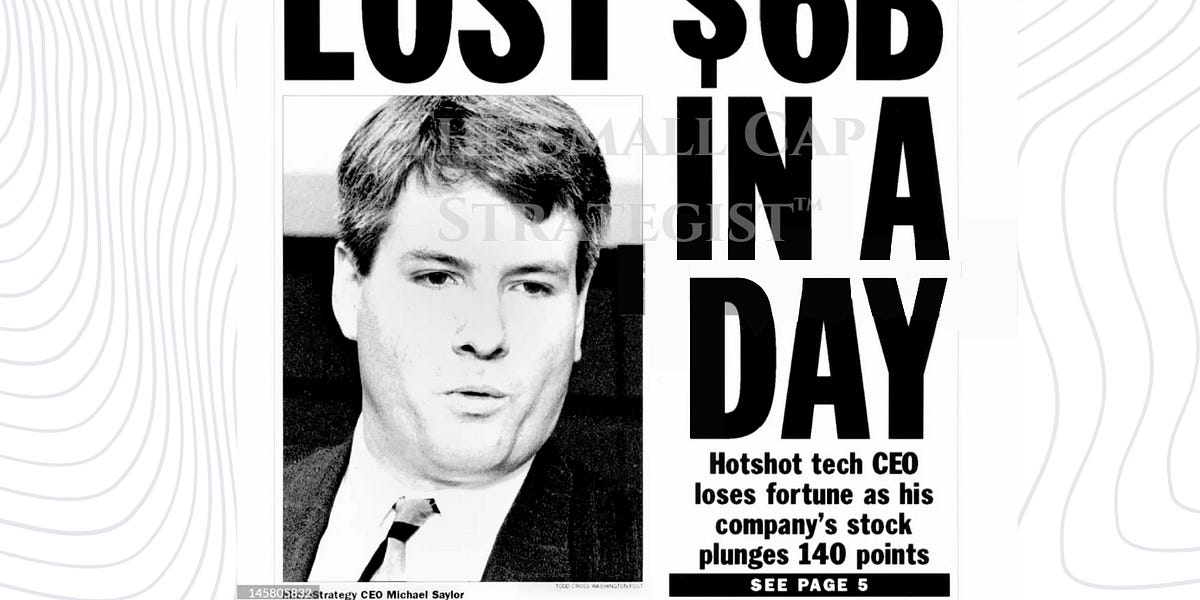

mstr stock price is down 60% on the year, bitcoin is nearing it's average buy price at around $75k. investors starting to worry abou their ability to pay their debts. looking pretty grim for, well, the stock holders and bitcoin holders. saylor says he can raise as much as he wants whenever he wants. i agree that he'll be fine, he has made hundreds of millions of dollars off this already.