You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Merged Bitcoin - Part 3

- Thread starter Dr.Sid

- Start date

-

- Tags

- bitcoin cryptocurrency

psionl0

Skeptical about skeptics

What is the "good reason"?there’s good reason to believe the price is being manipulated through wash trading on major crypto exchanges and pumped by unbacked stablecoins issued by the billions, in addition to other means.

dirtywick

Penultimate Amazing

- Joined

- Sep 12, 2006

- Messages

- 10,111

What is the "good reason"?

i've linked several articles discussing those topics earlier in the thread.

this is several years old and before the ftx collapse, but it seems like a decent summary and was easy to find on google, so here:

More Than Half Of All Bitcoin Trades Are Fake

A new Forbes analysis of 157 crypto exchanges finds that 51% of the daily bitcoin trading volume being reported is likely bogus.

www.forbes.com

www.forbes.com

and it's not hard to find information about tether, the mystery around it's reserves, and it's role in bitcoin transactions on exchanges. they've minted over $100b more tether since that article was written, and it's more prominent than it was at the time

So, who wants to buy some Bitcoin...?

"“Individuals held against their will in the compounds engaged in cryptocurrency investment fraud schemes, known as ‘pig butchering’ scams, that stole billions of dollars from victims in the United States and around the world,” the release said.

"The scams duped people contacted via social media and messaging applications online into transferring cryptocurrency into accounts controlled by the scheme with false promises that the crypto would be invested and produce profits, according to the office.

"“In reality, the funds were stolen from the victims and laundered for the benefit of the perpetrators,” the release said. “The scam perpetrators often built relationships with their victims over time, earning their trust before stealing their funds.”

"Prosecutors said that hundreds of people were trafficked and forced to work in the scam compounds, “often under the threat of violence.”"

"DOJ seizes $15 billion in bitcoin from massive ‘pig butchering’ scam based in Cambodia"

www.justice.gov

www.justice.gov

"“Individuals held against their will in the compounds engaged in cryptocurrency investment fraud schemes, known as ‘pig butchering’ scams, that stole billions of dollars from victims in the United States and around the world,” the release said.

"The scams duped people contacted via social media and messaging applications online into transferring cryptocurrency into accounts controlled by the scheme with false promises that the crypto would be invested and produce profits, according to the office.

"“In reality, the funds were stolen from the victims and laundered for the benefit of the perpetrators,” the release said. “The scam perpetrators often built relationships with their victims over time, earning their trust before stealing their funds.”

"Prosecutors said that hundreds of people were trafficked and forced to work in the scam compounds, “often under the threat of violence.”"

"DOJ seizes $15 billion in bitcoin from massive ‘pig butchering’ scam based in Cambodia"

Largest Ever Seizure of Funds Related to Crypto Confidence Scams

The U.S. Attorney’s Office filed a civil forfeiture complaint in U.S. District Court for the District of Columbia against more than $225.3 million in cryptocurrency. According to the complaint, the U.S. Secret Service and the FBI used blockchain analysis and other investigative techniques to...

Last edited:

psionl0

Skeptical about skeptics

So, who wants to buy some Bitcoin...?

That's not a problem with bitcoin. It's a problem with trusting others with your bitcoin.The scams duped people contacted via social media and messaging applications online into transferring cryptocurrency into accounts controlled by the scheme with false promises that the crypto would be invested and produce profits, according to the office.

Last edited:

It kind of is a problem with Bitcoin. Why do you suppose this character chose to exploit people who have Bitcoin? Why didn't he or others engage in this scheme with fiat currency? Madoff did. Doing this online, internationally, though, is different. Crooks probably could do something like this targeting fiat currency, but cryptocurrency offers criminals several advantages. One is the poor regulation and oversight. Another is the supposed anonymity. It's supposed to be very difficult to find out who owns the Bitcoin or where it went, never mind recovering it.That's not a problem with bitcoin. It's a problem with trusting others with your bitcoin.

psionl0

Skeptical about skeptics

That is just special pleading. This is just a run of the mill "You can trust me to make a profit for you if you give me your money" type scam.It kind of is a problem with Bitcoin. Why do you suppose this character chose to exploit people who have Bitcoin? Why didn't he or others engage in this scheme with fiat currency? Madoff did. Doing this online, internationally, though, is different. Crooks probably could do something like this targeting fiat currency, but cryptocurrency offers criminals several advantages. One is the poor regulation and oversight. Another is the supposed anonymity. It's supposed to be very difficult to find out who owns the Bitcoin or where it went, never mind recovering it.

It you remember that you can't trust anybody who says "you can trust me" then your crypto is just as safe as fiat. The only caveat is that you need to follow some elementary principal guidelines to safeguard your wallet against hackers and equipment failures.

dirtywick

Penultimate Amazing

- Joined

- Sep 12, 2006

- Messages

- 10,111

some of the biggest advantage of crypto to scammers is there's no third party to stop or flag transactions, that the transactions are final and irreversible as soon as they are made, and that they allow access to american dollars as a way around international sanctions. this really benefits russian and chinese and north korean, and other scammers who can trick people into sending crypto in pig butchering and romance scams for example, where it would be much more difficult or impossible to do through a bank or credit card.It kind of is a problem with Bitcoin. Why do you suppose this character chose to exploit people who have Bitcoin? Why didn't he or others engage in this scheme with fiat currency? Madoff did. Doing this online, internationally, though, is different. Crooks probably could do something like this targeting fiat currency, but cryptocurrency offers criminals several advantages. One is the poor regulation and oversight. Another is the supposed anonymity. It's supposed to be very difficult to find out who owns the Bitcoin or where it went, never mind recovering it.

really at this point, if any private party is asking for any kind of payment in crypto when you could easily be using us dollars, it's pretty likely to be a scam.

Last edited:

dirtywick

Penultimate Amazing

- Joined

- Sep 12, 2006

- Messages

- 10,111

the anonymity aspect as well is pretty interesting. in terms of an overseas scammer, yes they're effectively anonymous. you can open a new wallet at any infinite amount of times. they often don't since they're not particularly worried about getting caught, and eventually they shift the crypto they stole over to an exchange that will deal with their nation's banking system and get as much cash out as they can. but you're extremely unlikely to identify who this person is and convince them to send your crypto back to you.

but once you've identified the owner of the wallet, you can see their entire transaction history and you go from completely anonymous to completely exposed. so if you could imagine a different world where bitcoin is massively adopted as a currency, and you take your future stalker ex out on a date and send them some crypto to pay for your half of the meal, and they now have access to your entire financial history. or maybe the waiter that took the payment is your newest stalker, or the owner of the restaurant, or your financially abusive spouse your cheating on, or etc etc etc

or maybe someone in this transaction chain made a typo and accidentally sent the money to a dead wallet and the money is forever lost. or maybe a keylogger on your computer compromised the wallet and it got drained before you could pay for your meal. and maybe you forgot your seed phrase for your other wallet and that money is now in a dead wallet too. what, are you going to do? call customer service? ask for a new password?

and if you haven't ever, you should hop over to a crypto enthusiast space on your favorite social media site and ask how they recommend you store your crypto safely now, when you're not even using it regularly. probably going to hear something about having it in a cold wallet in a safe with parts of the seed phrase in 3 separate physical locations on acid etched stainless steel plates in lock boxes so that if one is compromised then you'll have the other 2 and...

there are all these little impracticalities

but once you've identified the owner of the wallet, you can see their entire transaction history and you go from completely anonymous to completely exposed. so if you could imagine a different world where bitcoin is massively adopted as a currency, and you take your future stalker ex out on a date and send them some crypto to pay for your half of the meal, and they now have access to your entire financial history. or maybe the waiter that took the payment is your newest stalker, or the owner of the restaurant, or your financially abusive spouse your cheating on, or etc etc etc

or maybe someone in this transaction chain made a typo and accidentally sent the money to a dead wallet and the money is forever lost. or maybe a keylogger on your computer compromised the wallet and it got drained before you could pay for your meal. and maybe you forgot your seed phrase for your other wallet and that money is now in a dead wallet too. what, are you going to do? call customer service? ask for a new password?

and if you haven't ever, you should hop over to a crypto enthusiast space on your favorite social media site and ask how they recommend you store your crypto safely now, when you're not even using it regularly. probably going to hear something about having it in a cold wallet in a safe with parts of the seed phrase in 3 separate physical locations on acid etched stainless steel plates in lock boxes so that if one is compromised then you'll have the other 2 and...

there are all these little impracticalities

psionl0

Skeptical about skeptics

The irony is that you are one of many posters who, over the past 15 years, has "revealed" that (apart from speculation) bitcoin is only used for illicit purposes.

Now you are claiming that bitcoin transactions are so public that they can't be used that way.

Now you are claiming that bitcoin transactions are so public that they can't be used that way.

psionl0

Skeptical about skeptics

as usual you're not reading anything closely enough and then missing the point as a result.

you can try and reread what i wrote but i'm not going to explain it again. you can just get it wrong.

If there is some subtlety in your post that negates this point then I can't be bothered to search for it.but once you've identified the owner of the wallet, you can see their entire transaction history and you go from completely anonymous to completely exposed.

No, cryptocurrency is rife with scandal, theft and scams the likes of which fiat currency has never seen.That is just special pleading. This is just a run of the mill "You can trust me to make a profit for you if you give me your money" type scam.

It you remember that you can't trust anybody who says "you can trust me" then your crypto is just as safe as fiat. The only caveat is that you need to follow some elementary principal guidelines to safeguard your wallet against hackers and equipment failures.

Last edited:

psionl0

Skeptical about skeptics

That which is asserted without evidence . . .No, cryptocurrency is rife with scandal, theft and scams the likes of which fiat currency has never seen.

Incidentally, your tangential video doesn't say anything new. I have made many of the same points myself.

EHocking

Penultimate Amazing

'BitQueen’s’ £5.5 Billion Fraud Busted

On 29 September 2025, the Metropolitan Police announced the successful conviction of two individuals following the world’s largest crypto seizure, currently valued at £5.5 billion.

This seizure has been no mean feat and is the result of a seven-year investigation headed up by the Metropolitan Police’s Economic Crime team, supported by the Crown Prosecution Service and the National Crime Agency. The investigation was originally launched in 2018 following the receipt of intelligence relating to Zhimin Qian (a Chinese national, also known as Yadi Zhang), referred to in the press as “BitQueen”.

It is understood that Qian obtained the Bitcoin through her leading role in a Ponzi investment scheme (known as the Lantian Gerui Fraud) which defrauded over 128,000 victims in China.

dirtywick

Penultimate Amazing

- Joined

- Sep 12, 2006

- Messages

- 10,111

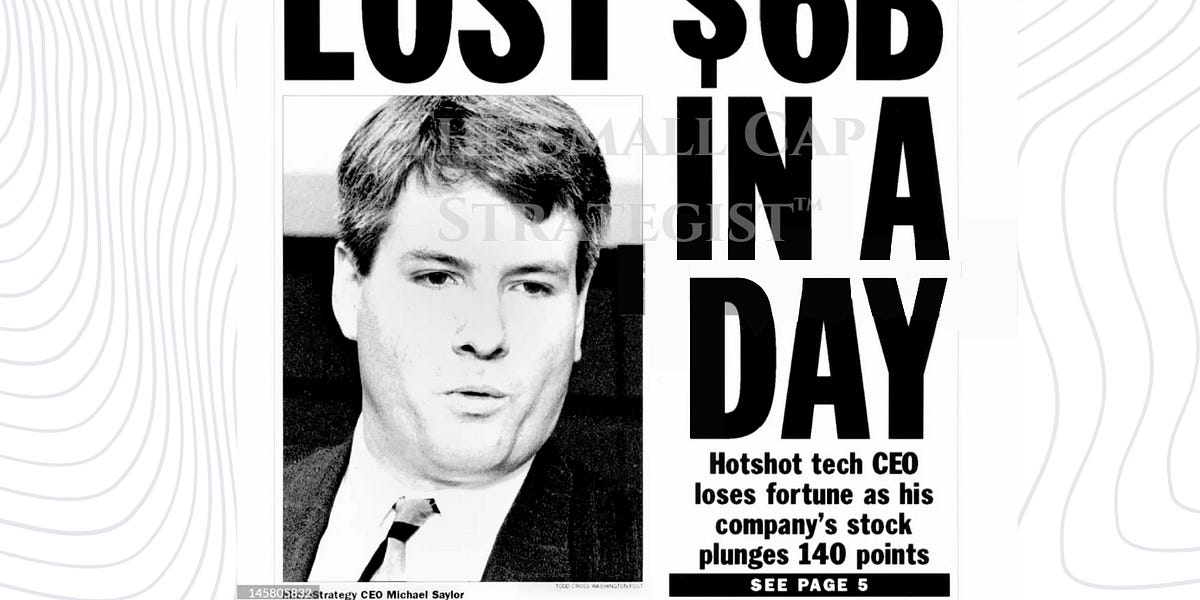

is it all over for strategy, the biggest bitcoin treasury? not looking great

dirtywick

Penultimate Amazing

- Joined

- Sep 12, 2006

- Messages

- 10,111

Don't Buy MicroStrategy, Inc - Mathematically Going To Zero

How a Leveraged Bitcoin Bet and a Fading Business Have Created a Bubble Destined to Pop - An In-Depth Analysis of MSTR's Strategy, Schemes, Fundamentals, and Outcomes.

The consequences for shareholders were devastating. On March 20, 2000, upon announcing its intention to restate its financials, MicroStrategy's stock collapsed by 62% in a single day, falling from a high of $333 per share to $120. The event erased an estimated $6 billion of Saylor's personal paper wealth and is widely considered a historical moment that helped burst the dot-com bubble. Ultimately, Saylor and the other executives settled the case with the SEC without admitting or denying wrongdoing. The settlement involved paying a combined total of approximately $11 million in disgorgement (disgorgement refers to the legal action of forcing a person or entity to give up profits they made through illegal or unethical activities, particularly violations of securities laws) and penalties, with Saylor personally disgorging $8.3 million and paying a $350,000 penalty.

Pulling future value into the present to create a misleading picture of current financial health is the fundamental mechanism of the 2000 fraud which is conceptually identical to the "intelligent leverage" model the company promotes today. Then, it was unearned revenue; now, it is the unrealized value of a speculative asset financed by diluting future shareholders.

as both the bitcoin price and stock price continue to drop, thought michael saylor's past history of fraud that burst the dot com bubble might be of interest. could the same company under the same guy do the same thing twice?

The Great Zaganza

Maledictorian

- Joined

- Aug 14, 2016

- Messages

- 29,759

Mistrial declared for MIT brothers accused of $25M crypto heist. Deadlocked jury complained of tears, sleepless nights.

Anton Peraire-Bueno and James Peraire-Bueno were accused of pocketing $25 million from Ethereum traders in a blindingly fast fraud.

Trying to understand Ethereum leads to mental breakdowns.

Last edited: